FLASH: Gold Surge Impact on Security

How Record Prices Drive Criminal Expansion, Water Contamination, and Governance Across Operating Environments

Report Details

Initial Publish Date

Last Updated: 26 JAN 2026

Report Focus Location: Global

Authors: BK, NA, GSAT

Contributors: GSAT

GSAT Lead: MF

RileySENTINEL provides timely intelligence and in-depth analysis for complex environments. Our global team blends international reach with local expertise, offering unique insights to navigate challenging operations. For custom insights or urgent consultations, contact us here.

BLUF

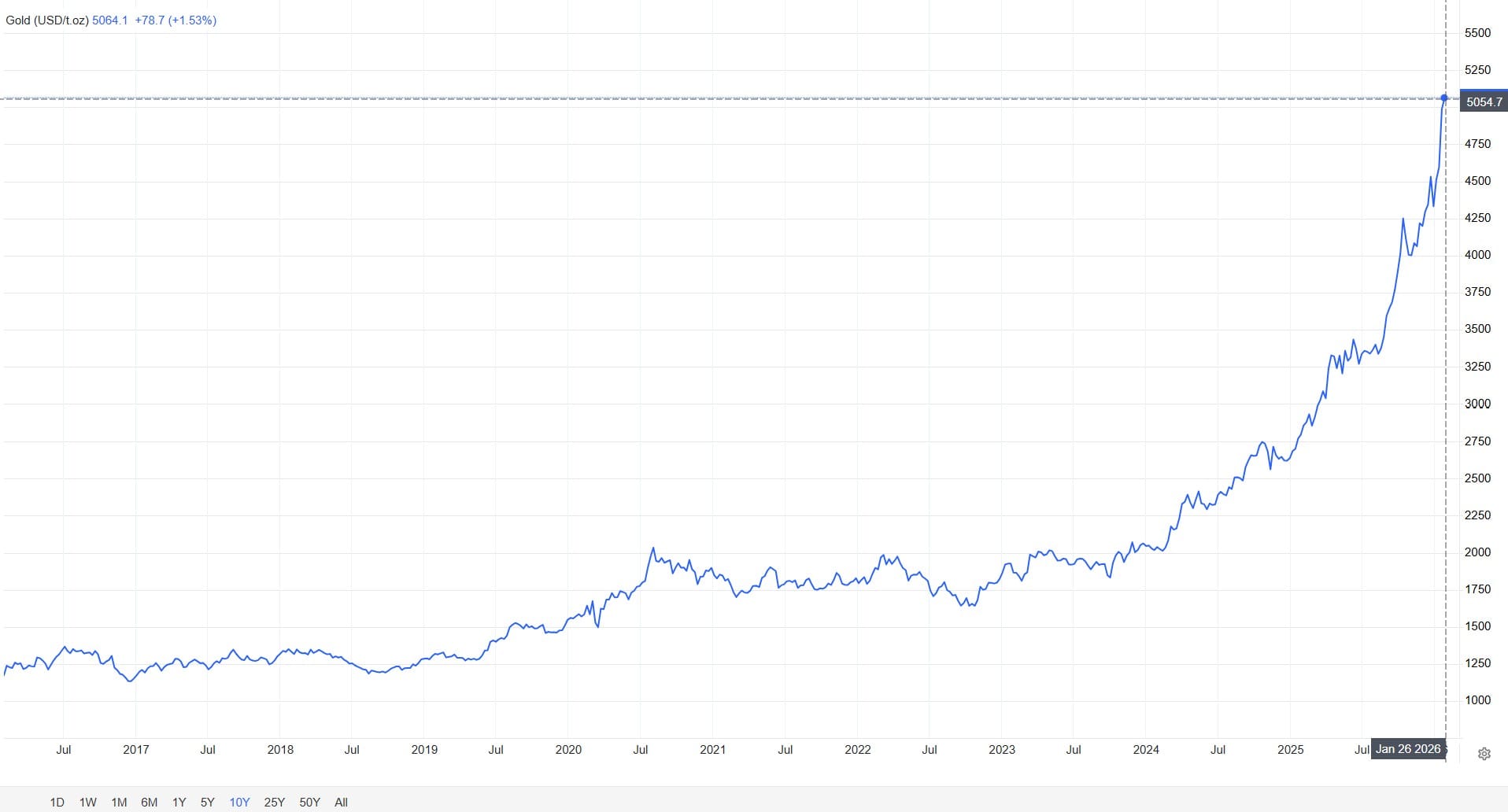

Gold surged past $5,100 per ounce on January 26, 2026, creating immediate operational security implications for organizations operating in 50+ gold-producing nations. The price milestone—driven by geopolitical tensions and safe-haven demand, directly correlates with intensified illegal mining, organized crime expansion, and infrastructure degradation in operating environments. Recent enforcement operations confirm illegal gold mining has become the fastest-growing revenue stream for transnational criminal networks.

Organizations with personnel, assets, or supply chains in affected regions should review security protocols and assess exposure immediately. For extractive industry clients, legal mining concessions face heightened encroachment risk. For NGO/development sector clients, water source contamination and community-company conflict are escalating. For corporate security directors, ESG compliance pressures and supply chain due diligence requirements are intensifying under EU regulations effective 2026.

Market Dynamics and Operational Context

Gold futures opened above $5,000 for the first time on January 26, marking a 17% gain in January 2026 alone and an 85% increase year-over-year from approximately $2,750 in January 2025. The rally reflects converging pressures: US-Europe tensions over Greenland, Federal Reserve policy uncertainty, tariff threats against Canada, and fading confidence in dollar-denominated assets. Goldman Sachs raised its December 2026 forecast to $5,400 per ounce, while Bank of America projects $6,000 by Spring 2026. Central bank purchasing has surged to 60 tons monthly compared to pre-2022 averages of 17 tons, with emerging-market central banks continuing reserve diversification away from the dollar.

The price trajectory creates direct security implications distinct from typical commodity volatility. Gold's unique characteristics—high value density, ease of concealment, difficulty of tracing once refined, and universal acceptance—make illegal extraction extraordinarily profitable for criminal networks. Unlike narcotics or other contraband, gold integrates seamlessly into legitimate markets after minimal processing. Each $100 per ounce increase materially expands the economic viability of illegal operations, pushing criminal groups deeper into remote regions and intensifying competition for productive sites.

Why It Matters

ANALYST REMARK: Every $100 increase in gold price translates to expanded criminal operating range. At $5,100/oz, illegal mining becomes viable in previously marginal locations, pushing criminal networks into new regions and increasing footprint overlap with legitimate operations. Organizations operating in Tier 2 countries should anticipate migration toward Tier 1 risk profiles if prices sustain above $5,000 through Q2 2026.

Remaining content is for members only.

Please become a free member to unlock this article and more content.

Subscribe Now